Why Management Creates the Biggest Difference

Many traders focus on entries, then sabotage the trade once it’s open. Poor management can turn a good setup into a small win or even a loss. Strong management keeps risk controlled while giving winners room to expand.

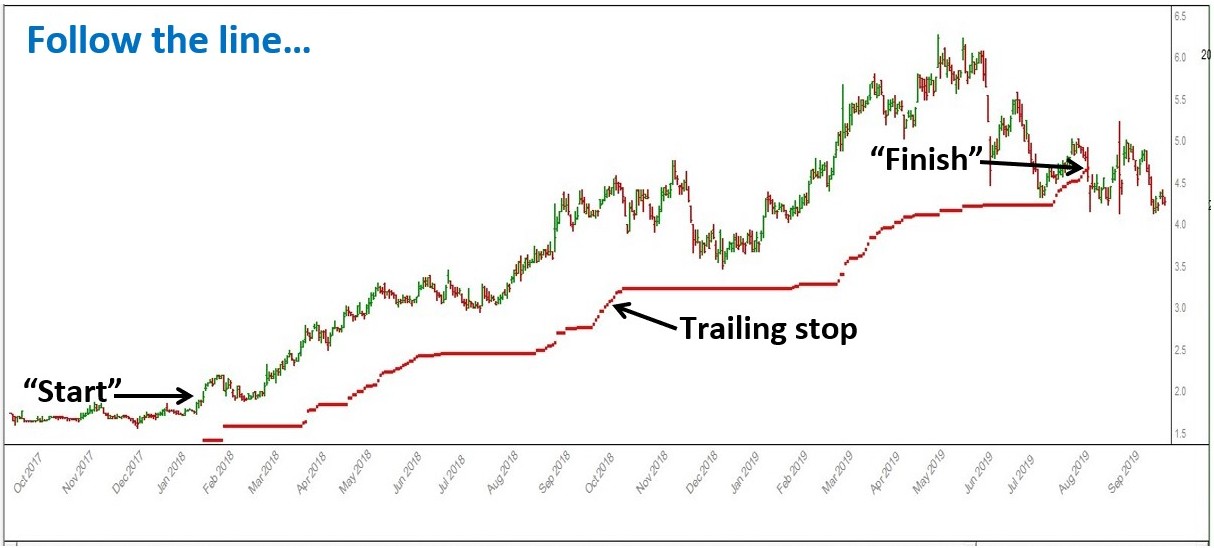

The objective is to avoid micro-managing every candle and instead follow structured rules for adding, protecting, and exiting.