The Hidden Danger of “Multiple Good Trades”

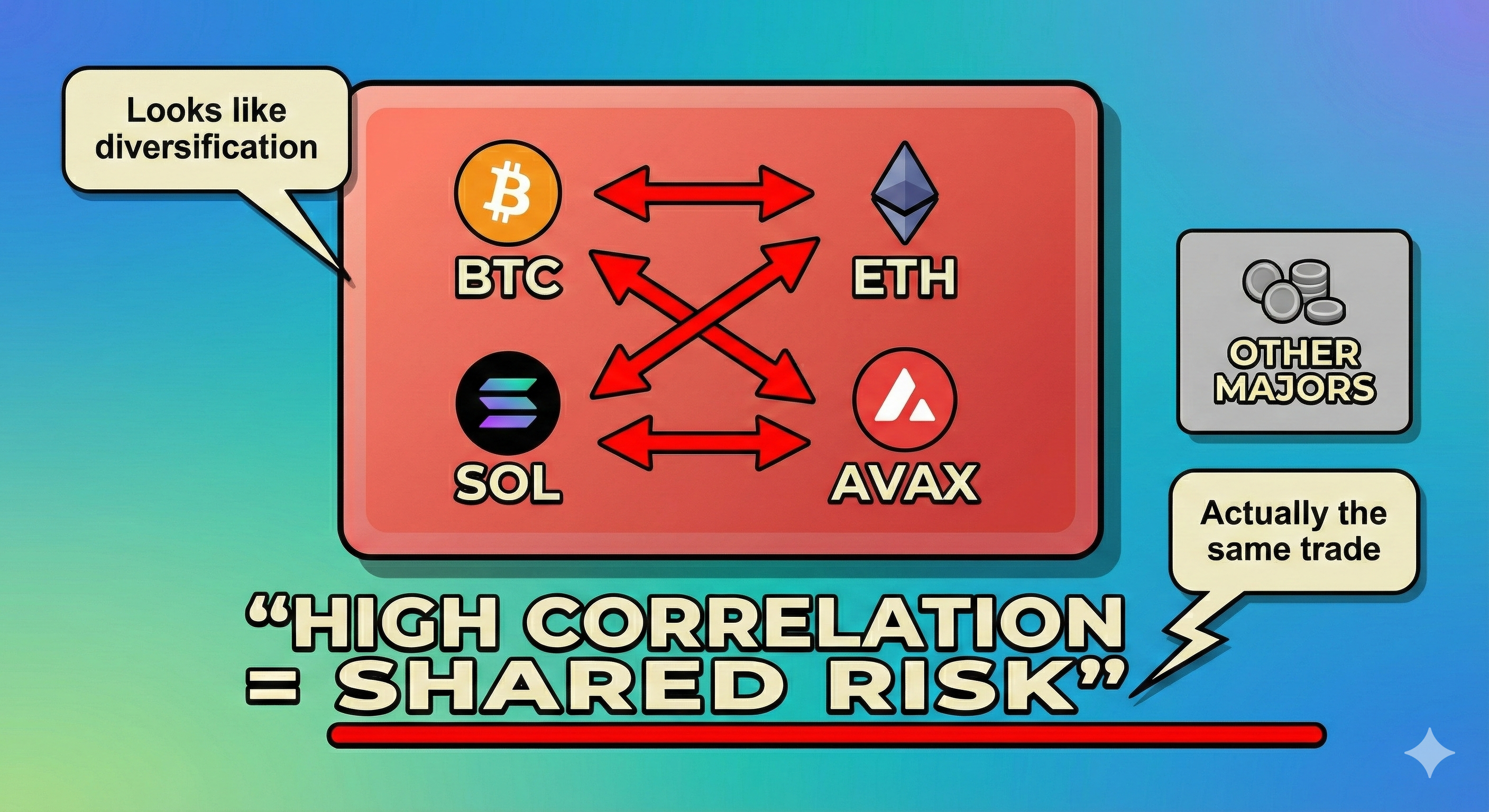

Opening several trades can feel safer because risk is split across different coins. In crypto, that’s often an illusion. Many coins are strongly correlated to BTC and ETH, meaning a single market move can hit all positions at the same time.

Portfolio risk is the sum of your exposures—not the number of separate trades you’ve placed.