Why Systems Decay Over Time

No trading system stays perfect forever. Volatility regimes shift, market participation changes, and edge can compress.

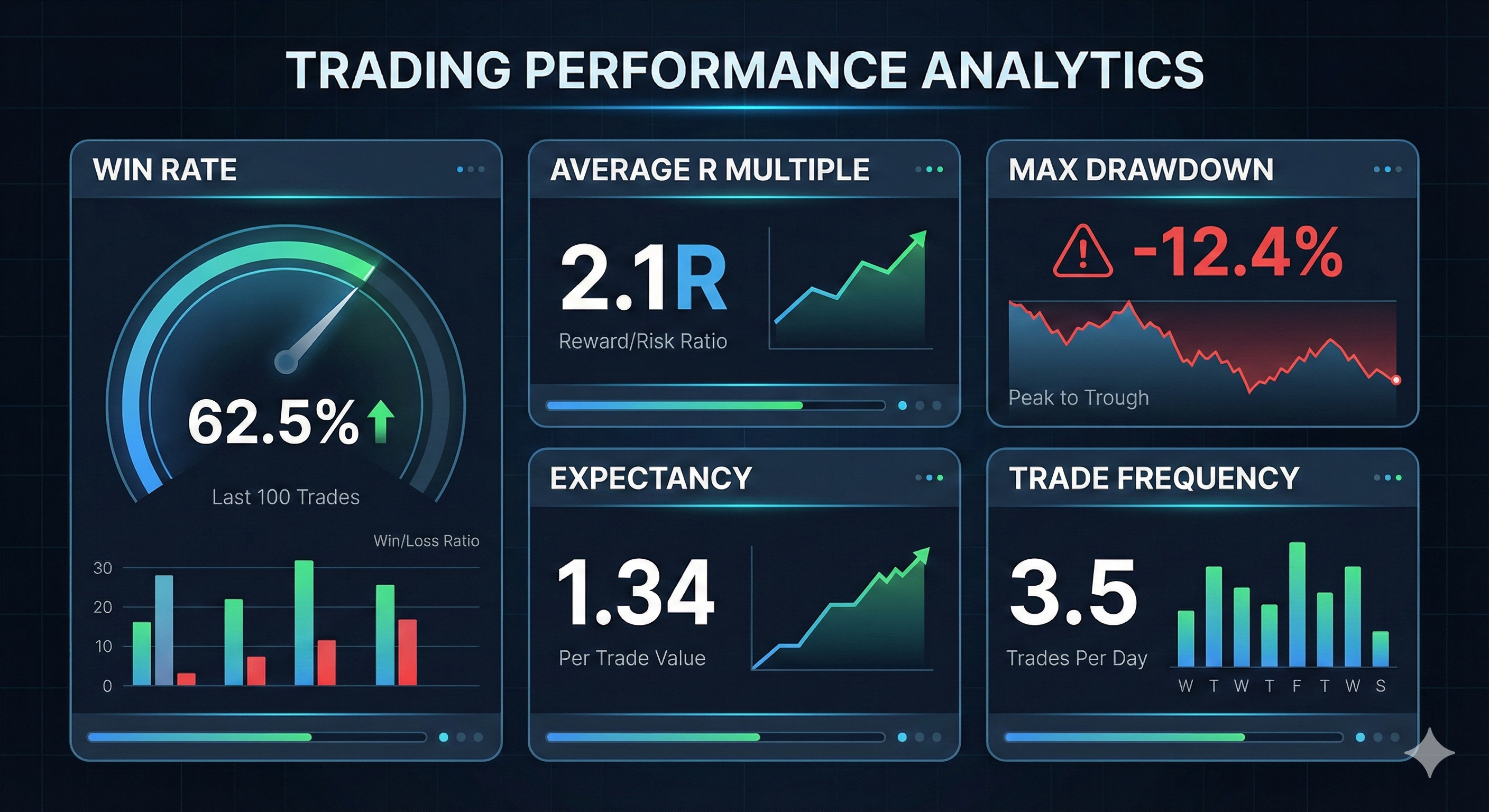

The goal is to identify whether a losing period is normal variance (expected drawdown) or real degradation (structure has changed). That prevents panic changes during a standard rough patch.