What Makes a High-Probability Entry

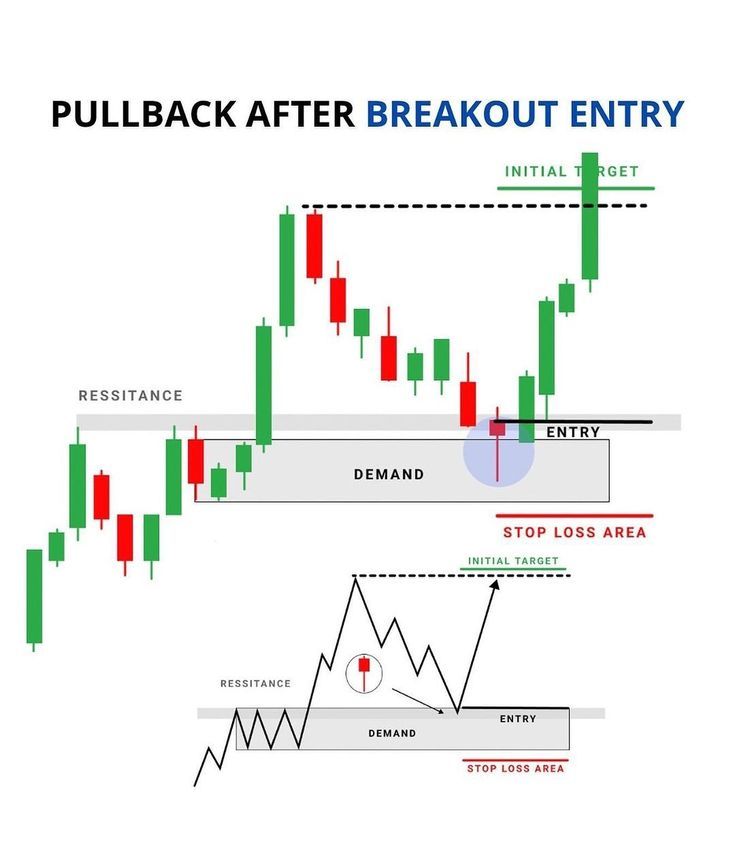

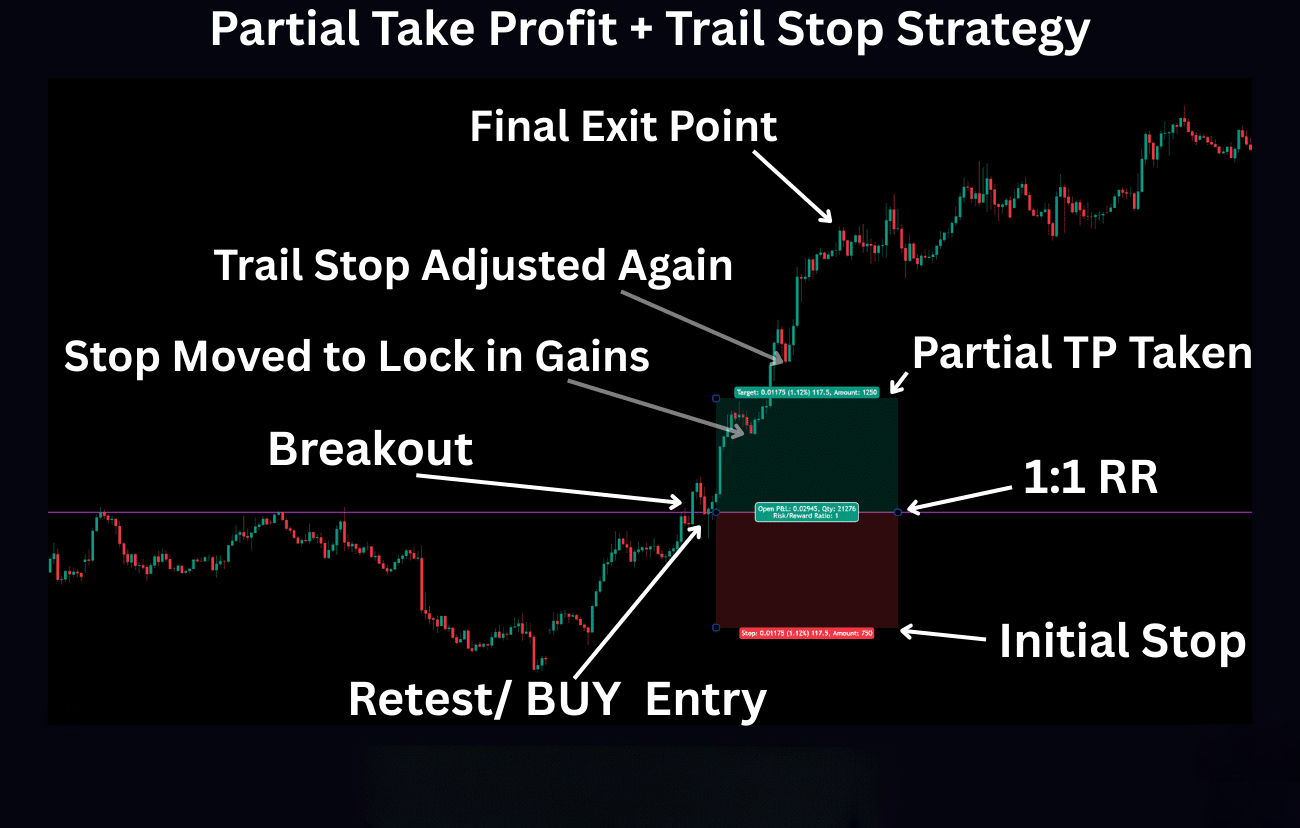

High-probability entries happen when structure, trend, and liquidity all point in the same direction. When the higher timeframe is trending, lower timeframe structure supports that direction, and price reacts cleanly at key levels, the probability of follow-through increases.

Instead of hunting for trades on every candle, the aim is to wait until multiple conditions align, then execute once with confidence.