Why Psychology Decides Your Results

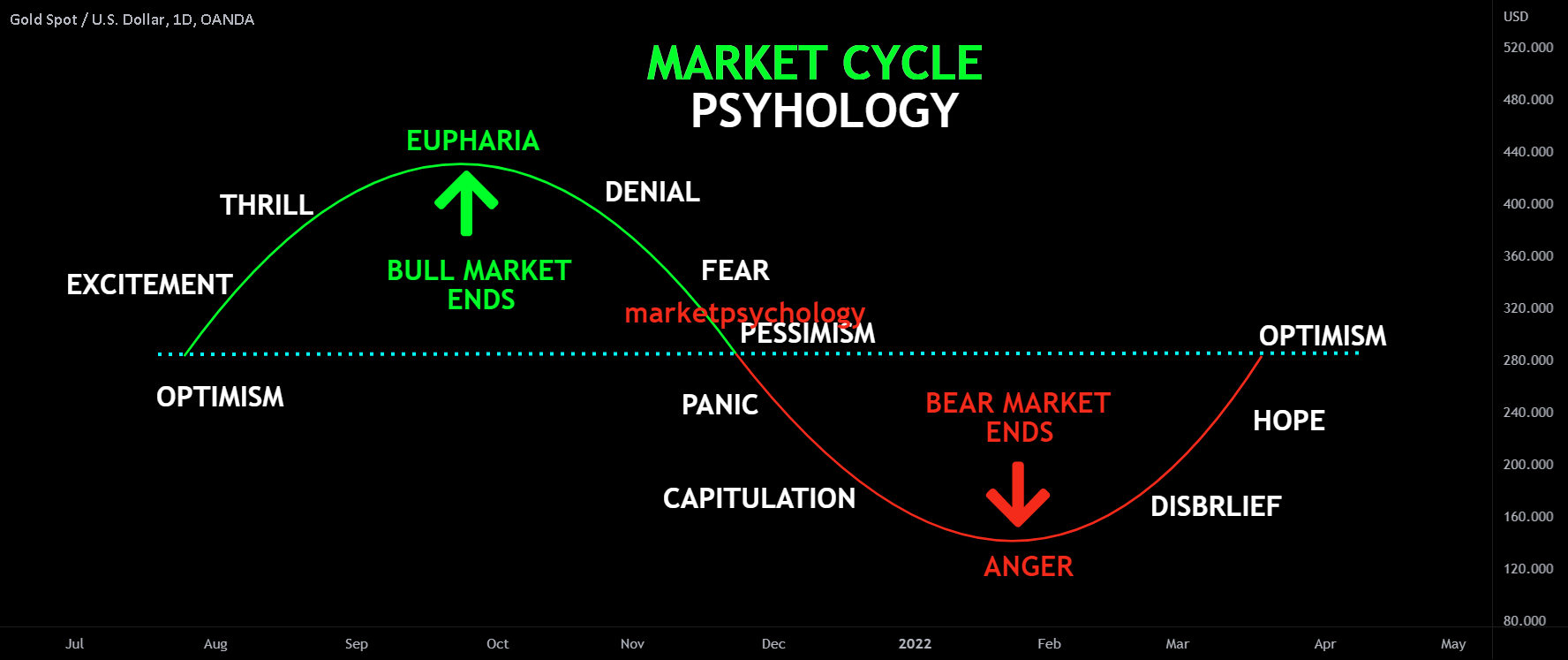

A trading edge on paper is useless if your behaviour can’t execute it. Most big losses come from emotional decisions—moving stops, adding to losers, or chasing moves out of FOMO—rather than from the strategy itself.

Once you accept that psychology is part of the system, not separate from it, you can start designing rules, routines, and safeguards to protect yourself from your own impulses.