Why Most Traders Never Become Consistent

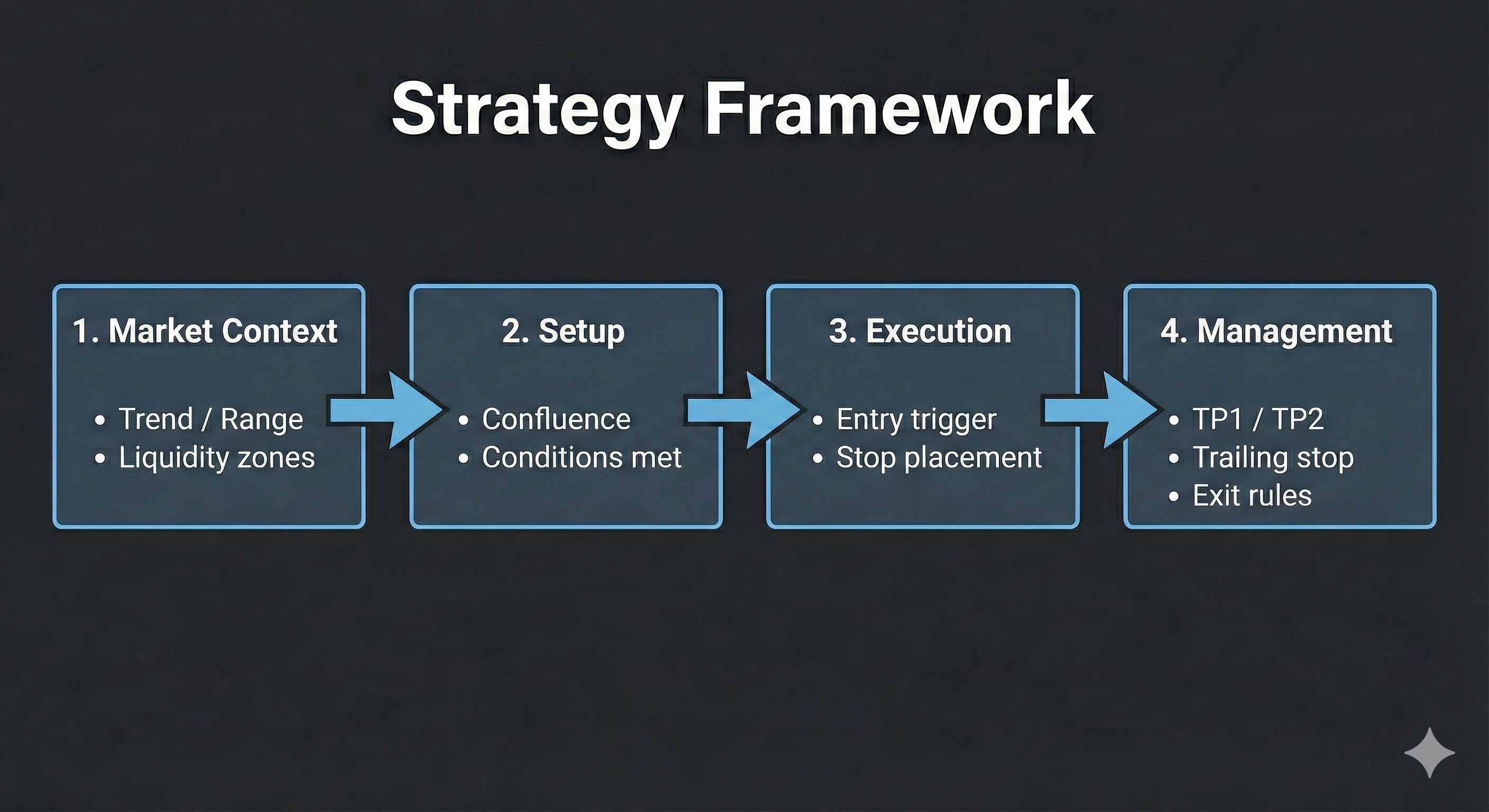

Inconsistency usually comes from randomness. If entries change daily, risk changes based on mood, and exits are decided in real time, results will always be unstable. A real strategy reduces decision-making pressure by defining what matters before the trade starts.

The goal is a process that can be repeated hundreds of times with minor adjustments—not a new set of rules for every chart.